Filing business taxes can be intimidating. You might have questions like: “Am I using the correct IRS forms?” “How do I prepare my financial statements for tax season?” or “What deductions can I take?” You aren't alone.

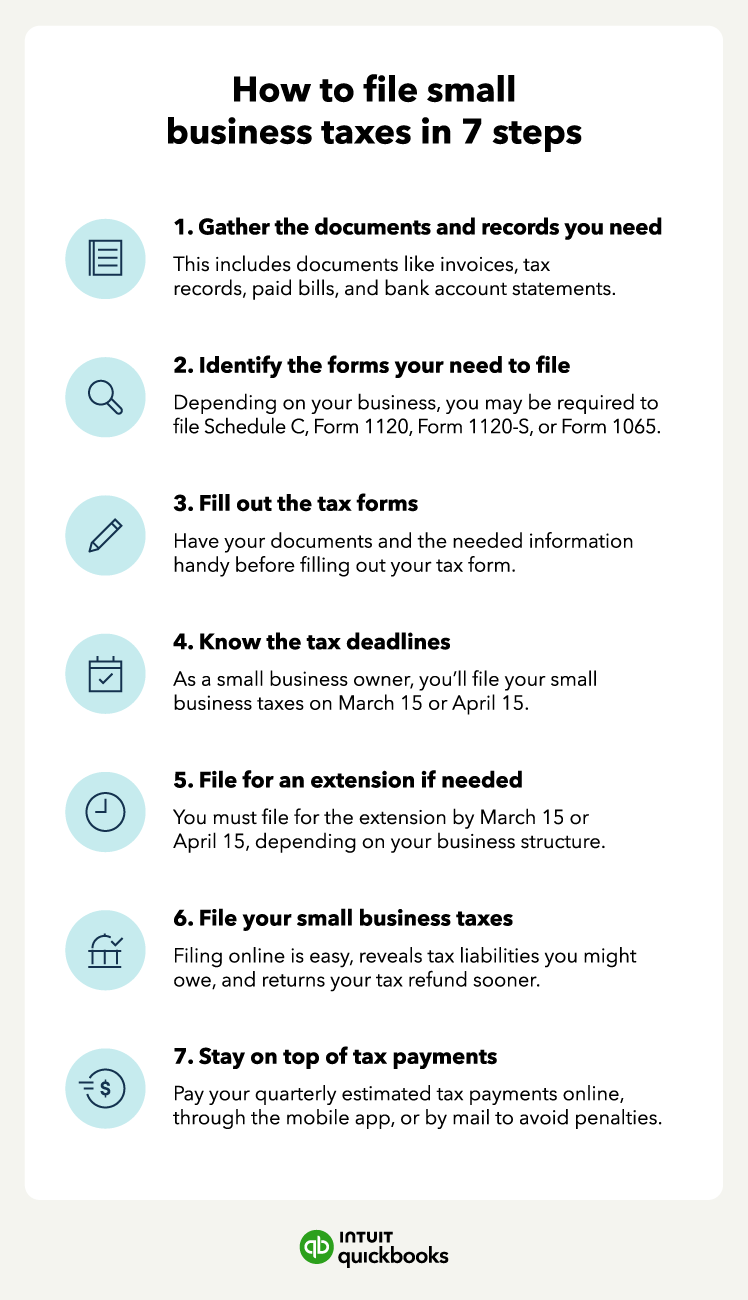

Let’s look at how to file taxes for small businesses in seven steps:

At the most basic level, you need to file your tax return each year through the IRS to figure out your tax liability. As a business, you might have to pay taxes that include:

For all these taxes, detailed records of business expenses you pay throughout the year can help lower your taxable income. You’ll need to get your company records together to report your business income and qualified business expenses.

This means gathering supporting documents for payroll, sales, purchases, and other qualified business expenses. Some of the small business documents you should gather when preparing your taxes include:

Using tax preparation or financial software to track expenses and transactions throughout the year is often easier than trying to gather all the info right before your due date. Live experts with QuickBooks Live Expert Assisted can provide guidance and answer questions for QuickBooks Online users, so you can stay organized and be ready for tax time.*

Confidently manage your finances with QuickBooks experts by your side.*

Start hereThe types of IRS forms you’ll need to fill out to file small business taxes depend on your business structure.

Here are the small business tax forms you might need to file your return:

If you want your business to be taxed as a C corporation, then you use Form 1120. If you want your LLC to elect to be treated as an S corporation, timely file Form 2553.

When filling out your small business tax forms, carefully follow each step and provide accurate information. If you’re filing using Schedule C , the form is a bit less complex, as it is only two pages.

Form 1065, Form 1120, and Form 1120S are more extensive and might require a bit more time to fill out. Be prepared with all of the required information, and have your supporting documents handy before filling out your form. Using accounting software can help you stay organized.

During some tax years, the due date for sending in your personal income tax return or small business tax return falls on a holiday or a weekend. If that occurs, the new tax deadline is the next business day.

Here are the key tax filing dates and deadlines you’ll want to be aware of:

A small business tax prep checklist and calendar reminders can help you get clear on your due dates to make filing business taxes easier.

Learn how you can close out the financial year with ease using QuickBooks this tax season.

Need to push back your deadline? You can file for a business tax extension to send your taxes in later with Form 7004 . This form grants a six-month extension to file, though it doesn't provide extra time to pay. Get the extension filed before the deadline so you don’t have to pay penalties.

The tax extension deadlines for small businesses are:

If you don’t file an extension and miss your tax filing deadline, you might face the Failure to File Penalty . The penalty is 5% of your unpaid taxes for each month or part of the month that your small business tax return is late.

Tip: State tax and extension deadlines vary by location. Research your local tax guidelines and due dates early in the filing process.

If you’re concerned about filing your taxes correctly, it’s worth enlisting the help of a licensed tax professional . With the help of a pro, you can ensure that you:

Note that e-filing is easier and faster than mailing, meaning you can get your tax refund faster too. The IRS offers many different filing options for small businesses to choose from.

Many businesses have to make estimated tax payments throughout the year. You're responsible for making estimated tax payments each quarter if:

You can pay your estimated taxes on the IRS website , from your mobile device using the IRS2Go app , or by mailing in Form 1040-ES . Not making estimated tax payments or underpaying your taxes could result in a penalty from the IRS.

You still have to file an annual small business tax return and calculate your tax liability for the year, even after paying quarterly taxes. If you didn’t pay enough through your quarterly tax payments, you’ll be responsible for paying the remainder when you file your tax return.

Though you might still owe money at the end of the year, making quarterly small business tax payments can help lower your end-of-year tax bill.

Small business owners can help lower their tax bill by maximizing deductions. Small businesses are allowed “ordinary and necessary” tax deductions that can help reduce taxable income.

A lower taxable income means you and your business might owe less money during the tax year. Some examples of small business tax deductions include business meals, travel expenses, home office costs, and vehicle use. It's important to keep a detailed record of all your small business tax deductions .

Here are some tips for keeping records:

If the IRS audits a business’s write-offs, these records can help avoid penalties and fines.

Filing taxes can feel challenging to navigate on your own. Intuitive software with reports and organized data can give you peace of mind during tax season.

Get guidance on prepping your books for tax time with virtual bookkeeping services like QuickBooks Live. An expert is by your side to answer questions answered with QuickBooks Live Expert Assisted .*

Yes, all business owners must file and pay federal income taxes according to IRS rules.

How can small businesses avoid paying high taxes?Small businesses can help reduce their tax liability by maximizing their deductions, using charitable contributions, and contributing to retirement accounts.

Can you file personal and LLC taxes together?Yes, single-member LLCs, which are taxed the same as sole proprietorships, can file their business taxes on their personal income tax return. They generally use Schedule C, which reports business income and expenses, and attach it to Form 1040.

*QuickBooks Live Expert Assisted requires QuickBooks Online subscription. Additional terms, conditions, limitations, and fees apply.

Recommended for you

Ultimate guide to small business tax forms, schedules, and resources

January 25, 2024

Small business tax preparation checklist 2024: 6 steps business owners should know

January 10, 2024

13 important documents to give your accountant for tax season

January 26, 2024

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.