- What the CN22 and CN23 customs declarations are

- When you are required to use a customs form

- The difference between the CN22 and CN23 custom declarations

- How to fill out the CN22 customs declaration

- How to fill out the CN23 customs declaration

- Generate your own Customs PDF Form

- Enhance your international shipping with Sendcloud

What is a customs declaration CN22 or CN23?

CN22 and CN23 custom declarations and are required customs documents for international shipping. They contain information about the goods you are shipping. This includes which goods are packaged inside your parcel, what their value is, who the shipper and receiver are, and which parties are involved in the shipping.

They are required documents that customs authorities use to keep track of which goods are entering and exiting their countries. These documents are important for topics such as taxation, security, public health, and environmental protection. Along with commercial invoices, these forms enable customs authorities to determine whether import duties must be paid for the goods you are shipping.

Parcels being shipped internationally are often read by a scanner. If your CN22 or CN23 customs declaration does not accurately describe the contents of your parcel, you could be in for a surprise! You may be fined up to 100% of the actual value of the merchandise.

When are you required to use a customs form?

Knowing when to use a customs form is the key to ensuring a smooth delivery and compliance with international shipping laws. Here’s a breakdown of when you’re required to use a customs form:

Shipping to a country outside the EU

You must fill out a customs declaration any time you are shipping a package to a country outside the EU and there’s no Free Trade Agreement between the two countries. If you’re shipping to a country within the EU, then no customs form is required.

For a comprehensive overview of all EU countries, be sure to check out the website of your national tax authority. And don’t forget to check out any exceptions that might apply in certain regions! There are some regions that are within the EU but are not part of the EU customs zone. Shipments to these regions are subject to customs control, so you must always include a CN22 or CN23 customs declaration with them too. These include:

- Any shipment to an EU overseas region that is not part of the customs union, such as Ceuta or Melilla.

- Any shipment to an EU overseas region that has different VAT requirements like the Canary Islands or French overseas territories.

Merchandise and documents

Merchandise shipments typically require customs declarations, whereas documents may not always need them. However, the rules may vary from one country to the next. In some places like the Bahamas, for example, a photograph is considered a document (not subject to customs control), while in Argentina, photographs are considered merchandise and must pass through customs.

National postal service vs. private carriers

When you’re using national postal services for international shipping, such as PostNL in the Netherlands or Deutsche Post in Germany, using a customs form is obligatory. These forms ensure your packages comply with international customs regulations and help them get through customs quickly and easily.

While using national postal services requires you to declare your packages to customs, it’s also a good idea to use customs forms when shipping with private carriers like DHL, UPS, FedEx, or DPD. These carriers often recommend including CN22 or CN23 forms with shipments. Due to their standardized format, these forms are recognized by customs authorities worldwide, enabling more efficient processing compared to non-standardized documents.

Summary of Customs Declaration Requirements

Shipping Situation

Customs Declaration Required?

Examples

Ready to save on international shipping costs? Check out our blog Cheaper International Shipping: 12 Top Tips to Reduce Your Costs for expert advice and practical tips. Start saving today!

What is the difference between CN22 and CN23 customs declarations?

Whether you use a CN22 form or a CN23 depends on the weight and value of the package.

What is a CN22 form and when do I have to use it?

A CN22 form is a specific type of customs declaration used for international shipments of goods valued at up to €425 and weighing less than 2 kilograms. The CN22 form is less detailed than the CN23 form. Often, it is attached to the address side of the parcel in the form of a sticker.

What is a CN23 customs declaration and when do I have to use it?

The CN23 is used for packages weighing from 2 to 20 kilograms with a value of €425 or more. It is similar to the CN22 form but contains more detail. The CN23 form can be attached to the outside of the parcel in a transparent envelope along with a CP71 form*. If possible, attach this envelope on the same side as the shipping label.

* The CP71 form must be included as a supplement to the CN23. It serves as an address card. Make sure this document is enclosed in the transparent envelope and visibly attached to the parcel in cases where you do not wish for the carriers of the shipment to be able to see what the contents of the parcel are from the CN23 form.

When to use a CN22/CN23

CN22

CN23

Depending on the carrier and the destination of the shipment, you need to include a commercial invoice in addition to the CN22/CN23. To avoid delays, we recommend including both. Always provide three copies of the commercial invoice: one for the country you are shipping from, one for the destination country and one for the recipient.

Completing customs declarations CN22/23 for international shipments

It is extremely important that you fill out the customs declaration correctly and as completely as possible. If you don’t do this, there’s a risk that the package will be delayed in customs, or you may even be subject to a fine. Incorrectly filled documents may also result in the package being returned or confiscated.

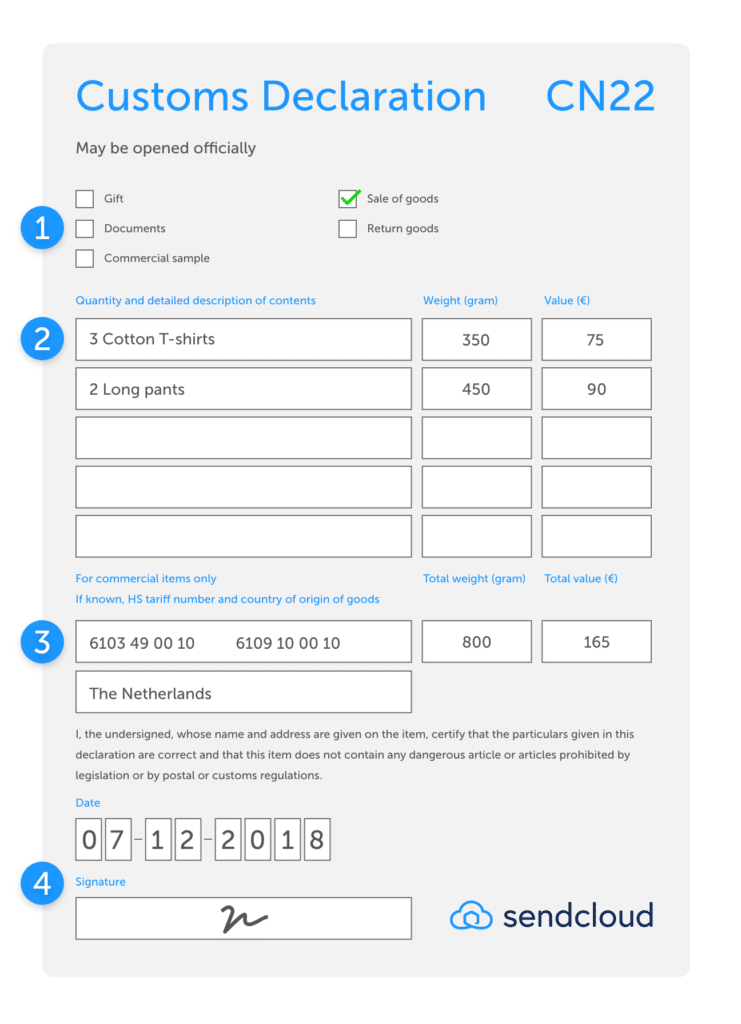

How do you fill out a CN22 customs declaration?

Remember: You must fill out a CN22 customs declaration if you are shipping a package that weighs less than two kilograms and has a value of less than €425. Here’s a step-by-step guide to the CN22 form:

Step 1:

Place a cross or tick-mark to indicate the contents of the parcel. For online retailers who sell products internationally, the choice will usually be ‘Sale of goods’. You may select ‘Commercial sample’ if you are only shipping samples or testers of your product. You can only choose one option per parcel.

Step 2:

Specify what’s inside the parcel. If you are shipping retail merchandise, commercial samples or return items, you must provide a detailed description of the contents. Always write the description in English or in the language of the destination country. The more clearly you describe the contents, the better your chances that the parcel will pass smoothly through customs. Always specify the product/product group:

- What type of product is it?

- What is the quantity?

- How much does it weigh?

- What is the retail value in euros (excluding VAT)?

Step 3:

Provide the international commodity code and the product’s country of origin. State the country in which the merchandise was produced or assembled and include the Harmonised System (HS) code for your product(s).

The HS or commodity code is a multi-digit code used by customs authorities around the world to categorize products. It contains ten digits, of which the first six are internationally standardized. So, always include at least a six-digit code and, if possible, also define the subcategory of your product. Depending on the country, different subcategories may be subject to different tax rates.

However, this is usually not the case, and the six-digit HS code is generally all you need to include. For more information, refer to the website of your national customs authority or visit www.tariffnumber.com or www.foreign-trade.com for a list of the HS codes.

Step 4:

Write the date of the shipment and sign the form. By signing the form, you declare that the document has been filled out correctly and that the parcel does not contain any banned or dangerous items. If the form is not signed, the shipment may be delayed or returned.

The items listed below are often not allowed to be shipped internationally:

- Aerosol sprays

- Alcoholic beverages

- Cigarettes

- Products with a limited shelf life

- Petrol or oil

- Fingernail polish

- Perfume

- Poison

- Lighters

- Fire extinguishers

- Gas masks

- Lottery tickets

- Rough diamonds

- Damaged batteries

Check the website of your national postal service for a general overview of goods and materials that are banned from international shipping. Your postal service should also be able to provide you with a list of items that are banned for shipment to each specific country. You can also use the UPS tool to find out import regulations that apply for each country or region.

TIP: Always fill out your customs forms in English. This helps prevent delays by ensuring that the documents are comprehensible for customs authorities in the destination country.

CN22 example

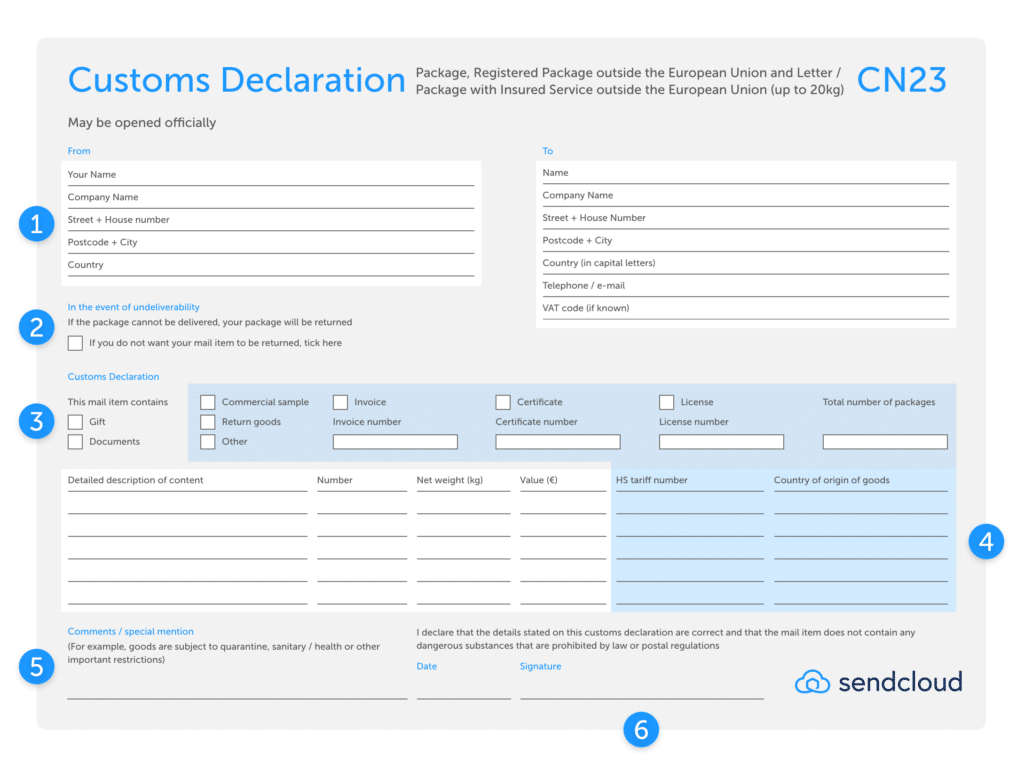

How do you fill out a CN23 customs declaration?

Remember: Use the CN23 customs form for packages weighing more than 2 kilograms and/or valued at more than €425. Here’s a step-by-step guide to the CN23 form:

Step 1:

Fill in the address information of the sender and receiver. To increase your chances of successful delivery, be sure to provide all the address details you know. Also include the customer’s telephone number, because, in some cases, it may be necessary to call them.

Step 2:

Indicate whether you want to have the parcel returned to you (or not) if it cannot be delivered. In some cases, it may not be possible to successfully deliver the parcel. Perhaps the information on the shipping label was incorrect, or the customs documentation was inaccurate or incomplete. Or the receiver may even refuse to accept the parcel.

In instances like these, a return shipping fee may be charged. By stating on the customs form that you do not want to have the package returned, you avoid having to pay unexpected return shipping costs. Of course, you also forfeit ownership of the parcel.

Step 3:

Specify what’s inside the parcel. Choose between commercial sample, return shipping or other. Also fill out the light blue shaded sections. Always describe the contents of the parcel as precisely as possible.

Step 4:

Provide the product’s commodity code and country of origin. State the country in which the merchandise was produced or assembled and include the Harmonised System (HS) code for your product(s). The same rules apply here as for the CN22 form. You can use our handy tool to find the right HS Code for your products.

The HS or commodity code is a multi-digit code used by customs authorities around the world to categorize products. It contains ten digits, of which the first six are internationally standardized. So, always include at least a six-digit code and, if possible, also define the subcategory of your product. Depending on the country, different subcategories may be subject to different tax rates.

However, this is usually not the case, and the six-digit HS code is generally all you need to include. For more information, refer to the website of your national customs authority or visit www.tariffnumber.com or www.foreign-trade.com for a list of the HS codes.

Step 5:

Comments or special notice: In some cases, products may be subject to quarantine, health/sanitation restrictions or other import regulations. It is important that you state this on the customs declaration. This applies to items such as food, medicine or living organisms.

Step 6:

Always remember to write the date and sign the form. Without the date and signature, the customs form is not legally valid and there is a chance that the parcel will not be delivered. Sign the form to declare that the document has been filled out correctly and that the parcel does not contain any banned or dangerous items.

TIP: Don’t forget to always keep copies of all documentation for yourself. If there’s an error in the handling of your shipment, you or your customer may be overcharged by customs authorities. In cases like that, you can still submit a modified invoice to customs as long as you have your documentation on hand.

CN23 example

Free Tool: Create your own customs declaration form

We love to make things easier for you. So we have developed a tool to help you easily generate the correct customs forms, which are ready-to-print and can be included with your international shipments. The tool will automatically complete all the required fields and determine whether you need to complete a CN22, CN23 or a Commercial Invoice. And then you can easily download your CN23 or CN22 online.

Check it out now!

Enhance your international shipping with Sendcloud

Streamline your international shipping process and ensure compliance with customs regulations with Sendcloud. Whether you’re shipping to countries outside the EU or within, our platform simplifies the customs declaration process for CN22 and CN23 forms.

By integrating Sendcloud into your shipping workflow, you can:

- Automatically generate CN22 and CN23 customs declarations based on your shipment details.

- Ensure accuracy and completeness in your customs documentation, reducing the risk of delays or fines.

- Seamlessly manage shipments to various destinations, whether you’re using national postal services or private carriers.

- Access a user-friendly interface that guides you through the customs declaration process, saving you time and effort.

Take your international shipping to the next level with Sendcloud!

Read all about international shipping with Sendcloud or sign up today to experience hassle-free customs declaration and efficient shipping worldwide. 👇

Johanna Menzel

As a content marketing specialist, Johanna writes educational and compelling content for Sendcloud. With her many years of experience in the B2B SaaS e-commerce sector and as a grammar and word nerd, she refines content to help 25,000 online stores take their shipping processes to the next level.